Vision Group is Uganda’s largest media enterprise by revenue and capitalization. Recently, the Group released a profit warning indicative of the woes of the media industry. Further more, there’s news that the Group is considering closing and restructuring some of its products. The Group is in the segment of Newpapers, Television, Radio and Printing services.

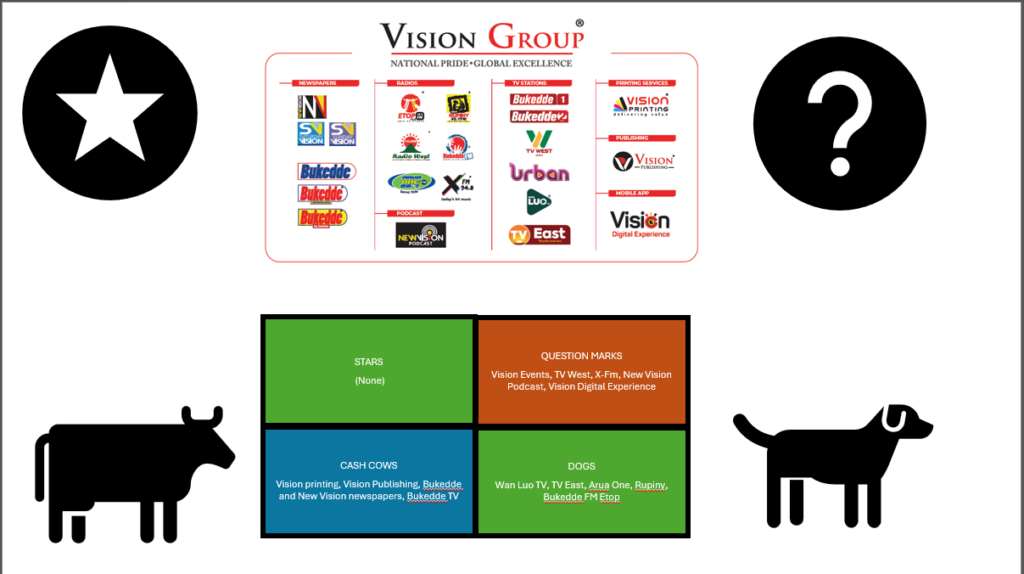

Ortega Group has recently performed a strategic analysis of Vision Group’s portfolio. The purpose is to point out the way Vision Group could approach the restructuring, but also to enhance the use of the Boston Consulting Group (BCG) matrix.

The matrix considers a business as a set of four categories. Within a business’ product line, there will be:

1. Stars (High Market Share, High Market Growth) ***

These are products of Vision Group with a high market share in a rapidly growing market. In the case of Vision Group, the rapidly growing market is that of the Digital Experience and the Events Experience. However Vision Group doesn’t command any stars here. This should be addressed as a criticality. Every business should have some stars for a sustainable competitive advantage and overall business returns. Does Vision Group have a plan of converting some of its Question marks into Stars?

Could the Vision events be exploded? Since Vision Group has showed experience in organizing events such as Bride and Groom Expo, Harvest Money Expo, Pakasa, it would be prudent to go strong in this field. The other potential product to amplify is the New Vision Podcast and the Vision Digital Experience. How do these get converted into stars? Why did Vision Group retire an event such as Rated Next?

2. Question Marks ((Low Market Share, High Market Growth) ???

Vision group should consider giving these kind of products more focus in order to transform them into stars. These are all the products within Vision Group that currently show potential. Vision Group’s question marks currently include Vision Events (not mentioned as part of their product line), TV West, New Vision Podcast and Vision Digital Experience. Thus, Vision Group should make a strong decision and strongly invest in them or retire them. A business should not keep question marks. Because Question marks speak to indecision within the firm. Urban TV and X-FM are also big question marks.

3. Cash Cows (High Market Share, Low Market Growth)

These are the businesses that are currently generating revenue for Vision Group. These are businesses in the mature markets or markets with slow-growth. The advantage with these businesses is that they currently guarantee cash-flow. Vision Group should consider maintaining them well. It could work on converting some into stars (depending on the market realities) or better, use them to generate cash that will be invested in some of its question marks so they can be converted into stars. Thus, if profits from Vision Printing can be used to enhance the Vision Digital Experience or the Vision Podcast. Ideally, the podcast should just be merged into the Vision Digital Experience. And then have the Events representing the Vision Experience (physical space). Among Vision Group’s cash cows are the Vision Printing, Vision Publishing, Bukedde Newspaper, Bukedde TV, New Vision Newspaper. Again, it would also be prudent to run the Newspapers under the publishing category. This will help focus the Group and stop it from spreading thin and cannibalizing itself. Thus, a number of New Vision’s journalists should also be working on some of the other publishing works such as Governmental publications. Again, Vision Group should rethink the idea of having two Bukedde TV stations (Bukedde 1 and 2) with both being Luganda-based.

4. Dogs (Low Market Share, Low Market Growth)

These should be the quick wins for New Vision. These are already under-performing products in the Group and should immediately be restructured, divested or discontinued. Among these are Wan Luo TV, TV East, Arua One FM, Rupiny, Bukedde Fm and E-Top. By cutting out the dogs, Vision Group will be in position to focus its efforts.

You can follow our previous financial reviews of the Vision Group here: