In our Part 1 of the New Vision series, we paused a question as to whether New Vision would return to profitability. Today, we’ve delved deeper into some of the financial ratios of New Vision in an attempt to get closer to the facts. Ortega Group can confidently say, should New Vision make a turnaround in 2024, it shall be among the most miraculous turnarounds in Ugandan corporate history.

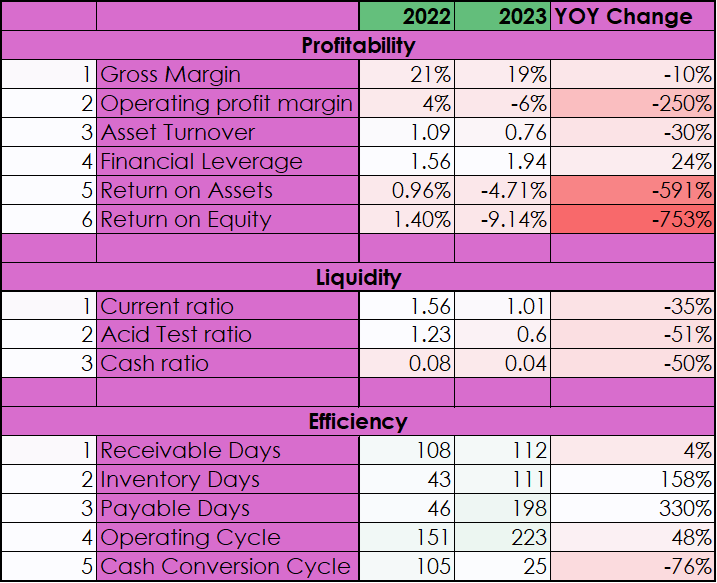

All indicators point to an emerging crisis at Uganda’s top publisher. Gross margin dropped by 10% in 2023 versus 2022. Operating profit margin dipped by 250%, 2023 versus 2022. Return on Equity dropped by 753%. These kind of dips are rarely witnessed in corporate firms considering that the year before, New Vision had declared a profit. Something doesn’t add up on the numbers. It’s possible that the 2022 profit needs to be revisited.

That’s why we believe that it’s almost impossible for New Vision to emerge stronger in 2024. With the 2023 dip, it takes years of sustained effort to return such a firm to profitability. New Vision has also gotten less efficient over time, Payable days increased from 46 to 198 days. What does this say about New Vision and its supplier relationships? Inventory days went from 43 to 111 days. Another worrying outcome.